Global AI Boom Triggers Severe Chip Shortage Crisis with DRAM Prices Doubling

Surging AI demand for high-bandwidth memory has diverted production from standard DRAM and flash chips, causing global shortages, price surges up to 170%, and supply chain disruptions for PCs, smartphones, and data centers.

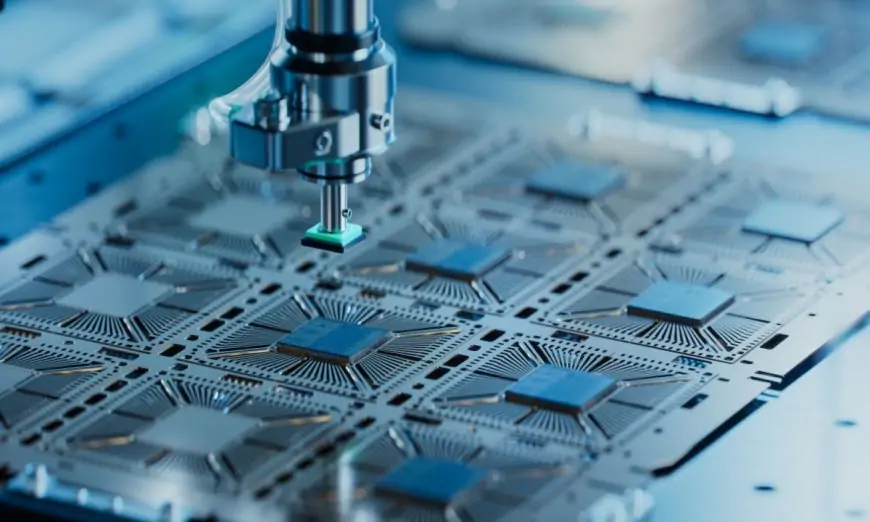

A new global chip shortage reminiscent of the 2020-2022 crisis has emerged, driven by explosive demand for advanced memory chips powering AI data centers, leading manufacturers to redirect production and causing DRAM and high-bandwidth memory (HBM) prices to double or more in some markets. Major suppliers like SK Hynix and Samsung have sold out HBM capacity through 2026, prompting a pivot away from conventional memory for consumer electronics, which has depleted inventories from double-digit weeks to just a few weeks' supply. This shift is straining smartphone makers in China, PC production, and even prompting Japanese retailers to ration hard-disk drives and memory-heavy devices.

The crunch stems from AI hyperscalers like Nvidia, Google, Microsoft, and Alibaba overwhelming foundries with orders for HBM and specialized semiconductors, creating ripple effects across the supply chain as new fabs for standard chips won't come online until 2027-2028. DRAM prices have surged over 170% year-over-year through Q3 2025, with lead times extending into 2027 and forcing downgrades in device storage options amid rationing. Even AI infrastructure faces delays, as data center builds pause due to memory constraints, potentially slowing the very productivity gains AI promises.

Geopolitical factors exacerbate the issue, with U.S. export controls and CHIPS Act delays hindering capacity ramps at foundries like TSMC, which plans price hikes for sub-5nm chips while expanding nine new facilities. Chinese firms face particular pressure, adjusting manufacturing plans as conventional memory dries up. Experts warn of a "super boom cycle" where AI reshapes demand, boosting global semiconductor sales to $686 billion through mid-2025 but risking broader tech sector slowdowns.

This supply crisis underscores the semiconductor industry's vulnerability to concentrated AI demand, pushing manufacturers toward diversification, nearshoring, and secondary markets while highlighting the need for accelerated fab investments to avert prolonged disruptions.