Tech Stocks' Wild Ride: Why Volatility Rules the Sector

Tech stocks swing wildly due to high valuations, AI competition, and macroeconomic shifts. Analysts dissect the drivers behind the sector’s turbulence.

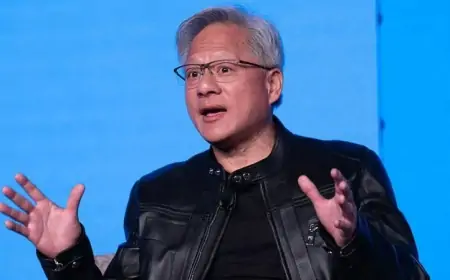

Tech stocks have become synonymous with market turbulence, with giants like Nvidia and Tesla experiencing rollercoaster rides in recent months. While these companies dominate indices and drive innovation, their share prices often reflect investor sentiment rather than fundamentals. Here’s why volatility persists in the sector:

Tech stocks, particularly those tied to AI, trade at elevated price-to-earnings ratios, making them sensitive to shifts in interest rates and growth forecasts. Susannah Streeter of Hargreaves Lansdown notes that investors gamble on future profits rather than current earnings, amplifying reactions to minor news. For example, Nvidia’s shares plunged after a Chinese AI app raised concerns about competition, while Tesla’s stock dropped over 40% early this year amid broader EV market skepticism.

Artificial intelligence has intensified competition, with firms racing to lead in chip design, cloud services, and generative AI. Vanderbilt’s Robert Whaley highlights that AI-driven volatility stems from fierce rivalry and investor anxiety about falling behind. Meanwhile, open-source AI models threaten incumbents, as seen in recent sell-offs triggered by cheaper alternatives.

The “magnificent seven” (Nvidia, Tesla, Meta, etc.) dominate major indices, so when markets correct, these stocks bear the brunt. Elliot Johnson of Evolve ETFs attributes recent declines to textbook market rotation, where past leaders face disproportionate selling during downturns. Tariffs and policy uncertainty under the Trump administration have also fueled volatility, with the S&P 500 entering its first correction since 2023.

After back-to-back years of 20%+ gains in 2023–2024, investors grew wary of stretched valuations. Vanguard’s Joe Davis warns that markets priced for “near perfection” leave little room for error, especially as disruptors emerge. The Nasdaq’s 12.3% drop in August 2024, led by Nvidia and Intel, underscored this fragility.